Videos and Articles

Critical updates on energy credits

The One Big Beautiful Bill Act (OBBBA) is changing the landscape of energy tax credits by accelerating expiration dates, leaving homeowners, businesses, and car buyers scrambling to capitalize on incentives for renewable energy and clean vehicles. This article covers several upcoming deadlines for anyone planning energy-efficient upgrades or investments.

Why Proper QuickBooks Bank Rules are Essential for Payment Accuracy

Precise payment coding in QuickBooks Online prevents duplicate entries, ensuring accurate cash flow and eliminating costly reconciliation errors.

MN Pass-Through Entity reminder

MN Pass-Through Entity reminder information

Tax traps for real estate investors and how to avoid them

Real estate investors- Stay informed and effectively manage your investments amidst an ever-evolving tax landscape.

When is an S-corp election the right move?

Your business is finally profitable, but is it profitable enough for an S-corp election? Learn the revenue, cash-flow, and compliance milestones that signal it's time.

Understanding the recently passed One Big Beautiful Bill Act

The One Big Beautiful Bill Act, passed by Congress and signed into law, provides significant tax relief for small businesses. Learn how to leverage these new policies for maximum benefits.

Understanding Safe Harbor 401(k) Plans

Navigating the complexities of 401(k) plans can be daunting for small and midsize businesses. Discover how the safe harbor 401(k) offers a simplified solution by easing administrative burdens while fostering employee financial well-being. Explore the advantages, key components, and strategic considerations to determine if it's the right fit for your business.

IRS Acknowledges Delay

Have you received an IRS notice despite paying taxes on time?

Summer Activities and your Tax Returns

Keeping track of summer activities may help you maximize deductions and credits, ensuring a smooth tax filing process next year.

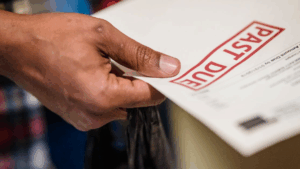

Missed the April 15 deadline? Here are some options you can take

The IRS has resources for individuals who missed the April 2025 tax filing deadline. These include online payment options and short-term or long-term payment plans. Despite penalties for late payment, taxpayers are encouraged to file and pay as much as they can immediately.

Smart Business Borrowing: balancing liquidity, leverage, and efficiency

Smart borrowing can fuel growth—or quietly erode your business's profitability if not managed with precision. This article explores how to size loans appropriately, avoid costly missteps, and align financing with your overall strategy.

Understanding the Implications of the ‘No Tax on Tips Act’ for Employers

The No Tax on Tips Act could potentially reduce the administrative burden on employers, particularly in the restaurant industry, by eliminating federal income taxes on tips. However, employers will still need to accurately track and report all tipped income for payroll and tax purposes.

Understanding Severance Pay and Final Paycheck Laws in Minnesota

In Minnesota, severance pay is not mandated by law but may be negotiated between employer and employee. It is taxable and should be reported as wages on an employee's income tax return. For more specifics, read below and/or consult our offices.

What to do if you receive a notice from the IRS

Did you receive a letter from the IRS? Learn what steps you should take and mistakes to avoid in responding to a notice.

Secure Digital Access to Social Security Numbers

The Social Security Administration introduces secure digital access to Social Security numbers, offering a modern, secure alternative to traditional physical SSN cards.

No results found.